Say hello to

Jip Kuijper (they/them)

+316 83 12 73 32

jip@bo-diversity.com

2025 is coming to an end, which means that everyone who is 18 or older needs to take a look at their health insurance! Especially if you are receiving gender-affirming care, or plan to receive it in 2026

This is the moment!

2025 is coming to an end, which means that everyone who is 18 or older needs to take a look at their health insurance! Especially if you are receiving gender-affirming care, or plan to receive it in 2026. Why is this so important? Health insurers sign contracts with healthcare providers, and each insurer decides for themselves which providers they contract.

What happens if you don’t do this? You might end up paying unnecessary costs out of pocket. If your health insurer does not have a contract with the healthcare provider where you receive care, you often have to pay part of the costs yourself. By mapping out your healthcare needs and choosing a suitable health insurer, you can save a lot of money.

Good to know: Gender-affirming care (transgender healthcare) is largely covered by the basic health insurance in the Netherlands.

What should you think about and pay attention to?

Find out which gender-affirming care you want or expect to receive in 2026, and which healthcare provider(s) will deliver this care.

Check the website of the healthcare provider(s) to see which health insurers they have contracts with for 2026.

Is the provider you want to use not yet contracted? Contact your health insurer for more information, and also check with the provider themselves for clarity.

Compare different health insurance plans using an independent comparison website such as Zorgwijzer.nl.

Based on the previous steps, decide which health insurer best fits your healthcare needs.

Important dates:

31 December: Last day to cancel your current health insurance.

31 January: Last day to take out a health insurance policy for 2026.

Our tips

We generally recommend a combination policy with free choice of provider. This usually allows you to choose your own healthcare provider, even if your insurer does not have a contract with them. This is especially useful if you do not yet know which provider you will receive care from, or if you are registered with multiple providers. Without free choice, you risk that care from a specific provider will not be reimbursed, or that you will have to pay more yourself. Depending on your insurer, their contracts, and the type of care (e.g. mental healthcare or specialist medical care*), part of the costs may come out of your own pocket. Non-contracted mental healthcare is often partially reimbursed; the exact amount depends on the insurer and the chosen policy.

Set your deductible to €385 and enable payment in instalments, so you pay your deductible spread out over time. If you end up not using it, you will get this money back at the end of the year. This helps prevent having to pay a large amount all at once.

Do you have a low income? You may be eligible for healthcare allowance (zorgtoeslag). You can check and apply for this via the Dutch Tax Authority (Belastingdienst).

You can also look into how ethical and sustainable your health insurer is. Health insurers sometimes invest their money in the arms trade or fossil fuels, which is harmful to the world. You can research this via eerlijkegeldwijzer.nl.

* Mental healthcare (GGZ): because reimbursement differences within mental healthcare are relatively small, you can decide for yourself whether a policy with free choice is relevant. This type of care includes expert opinions, diagnostics, and psychological support.

* Specialist medical care (MSZ): if you want or receive surgical or hormone care but do not yet know where, choose a policy with free choice. Reimbursement is usually high and you often do not have to pay anything yourself. This includes surgical care and endocrinology (hormone treatment).

Before taking out a health insurance policy, make sure to do your own research as well! Choose the insurer that best fits your healthcare needs.

What can I choose?

We have researched the most commonly used gender-affirming care providers and health insurers for you, including their contracts.

We selected a number of the largest health insurers and gender-affirming care providers, but not all of them.

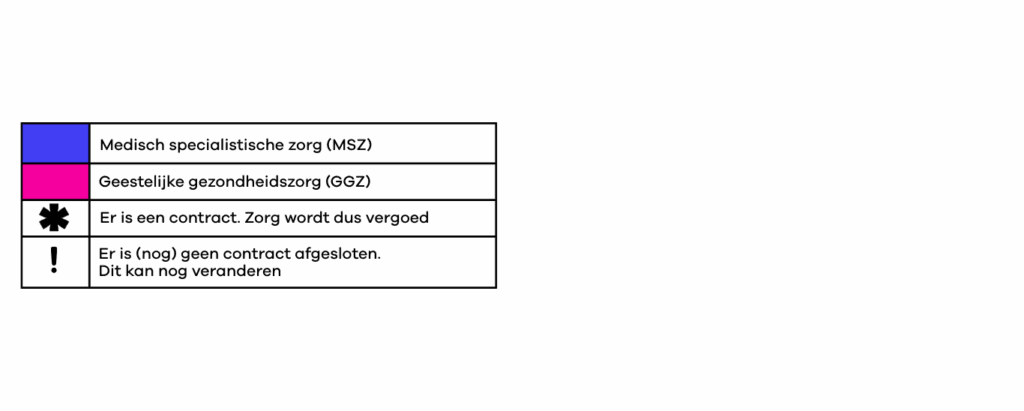

Each insurance group includes multiple insurers; check Zorgwijzer.nl for more information.In the table, a distinction is made between mental healthcare (GGZ) and specialist medical care (MSZ). Within gender-affirming care, expert opinions, diagnostics, and psychological support fall under GGZ. MSZ includes surgery (gender-affirming surgeries) and endocrinology (hormone care).

Disclaimer: this table was created using information available on 15-12-2025. New information may have become available since then. Always do your own research as well.

Do you still have questions after reading this blog, or is something unclear? Feel free to send Roan a message or an email he may be able to help you further!